Payroll 2023 calculator

It will confirm the deductions you include on your. All Services Backed by Tax Guarantee.

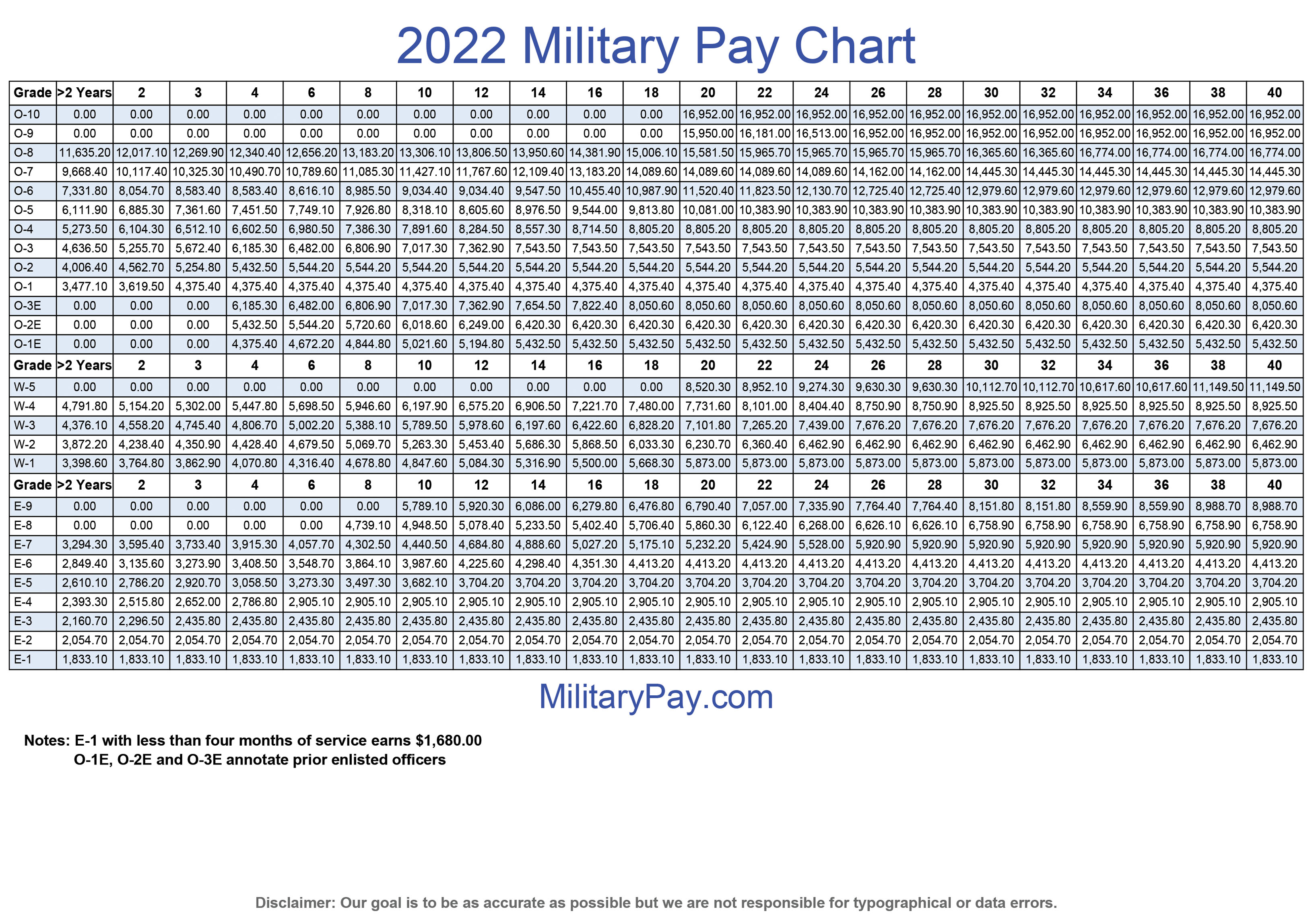

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

When you choose SurePayroll to handle your small business.

. Paycors Tech Saves Time. Ad Payroll So Easy You Can Set It Up Run It Yourself. 2 2022 The presidents alternative pay plan is an across-the-board base pay increase.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Discover ADP Payroll Benefits Insurance Time Talent HR More. Employers can enter an.

UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Prepare and e-File your.

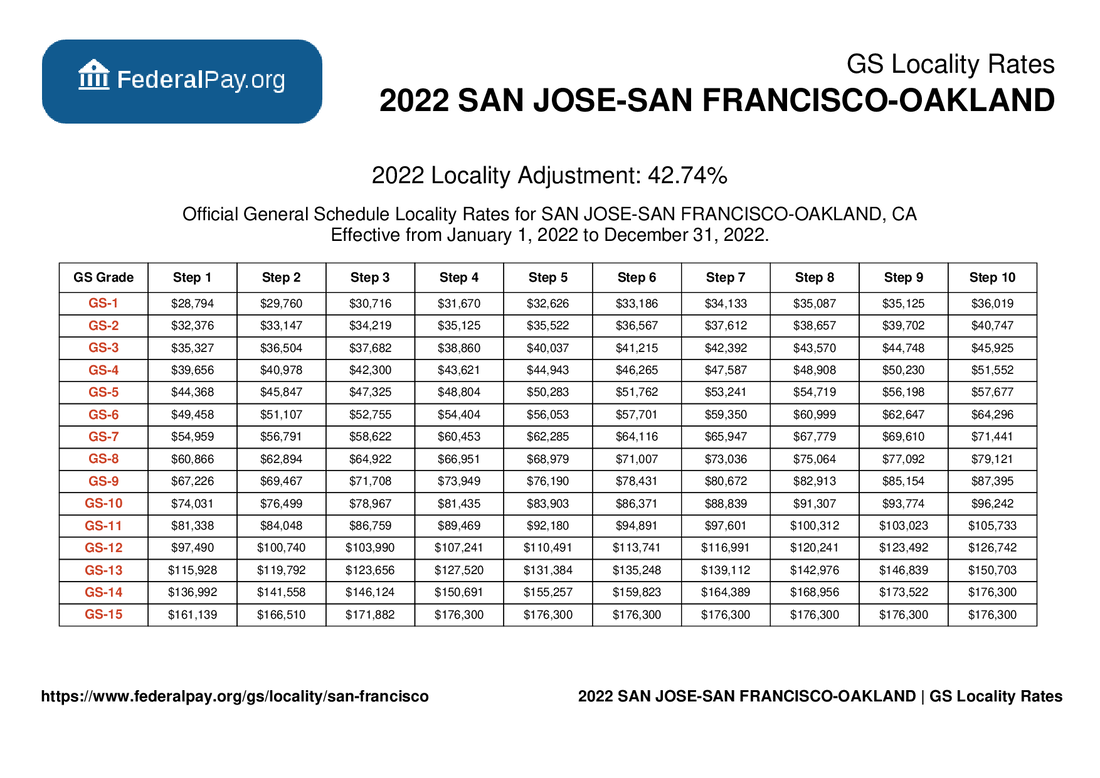

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. Free Unbiased Reviews Top Picks. Multiple steps are involved in the computation of Payroll Tax as enumerated below.

Our Expertise Helps You Make a Difference. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Discover ADP Payroll Benefits Insurance Time Talent HR More.

White House Formalizes Average 46 Pay Raise for Federal Employees in 2023 Sept. It will be updated with 2023 tax year data as soon the data is available from the IRS. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

Calculator and Estimator For 2023 Returns W-4 During 2022. Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

If payroll is too time consuming for you to handle were here to help you out. The US Salary Calculator is updated for 202223. Ad Process Payroll Faster Easier With ADP Payroll.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS. Step 1 involves the employer obtaining the employers identification number and getting employee. Ad Process Payroll Faster Easier With ADP Payroll.

The maximum an employee will pay in 2022 is 911400. We hope these calculators are useful to you. For example based on the rates for 2022-2023 a person who earns.

Plug in the amount of money youd like to take home. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Discover ADP Payroll Benefits Insurance Time Talent HR More.

2022 Tax Return and Refund Estimator for 2023 This Tax Return and Refund Estimator is currently based on 2022 tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Free Unbiased Reviews Top Picks.

Get Started With ADP Payroll. Ad The Best HR Payroll Partner For Medium and Small Businesses. Calculate Your 2023 Tax Refund.

On the other hand if you make more than 200000 annually you will pay. It will be updated with 2023 tax year data as soon the data is available from the IRS. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take. Ad Compare This Years Top 5 Free Payroll Software. Employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage.

The EX-IV rate will be increased to 176300. See where that hard-earned money goes - with UK. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Prepare and e-File your. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. 2023 payroll withholding calculator Senin 05 September 2022 Edit.

Ad Compare This Years Top 5 Free Payroll Software. FAQ Blog Calculators Students. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Take a Guided Tour. Get Started With ADP Payroll. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. 2023 Wage Benefit Calculator.

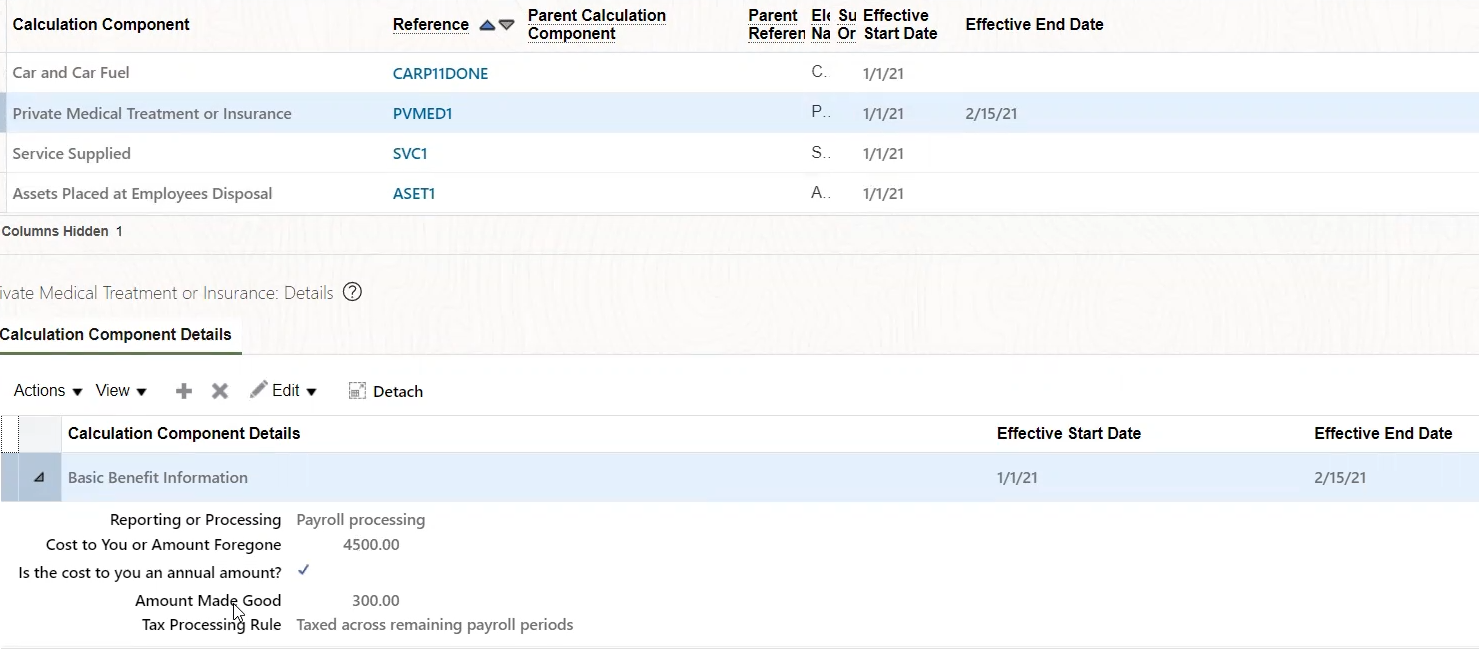

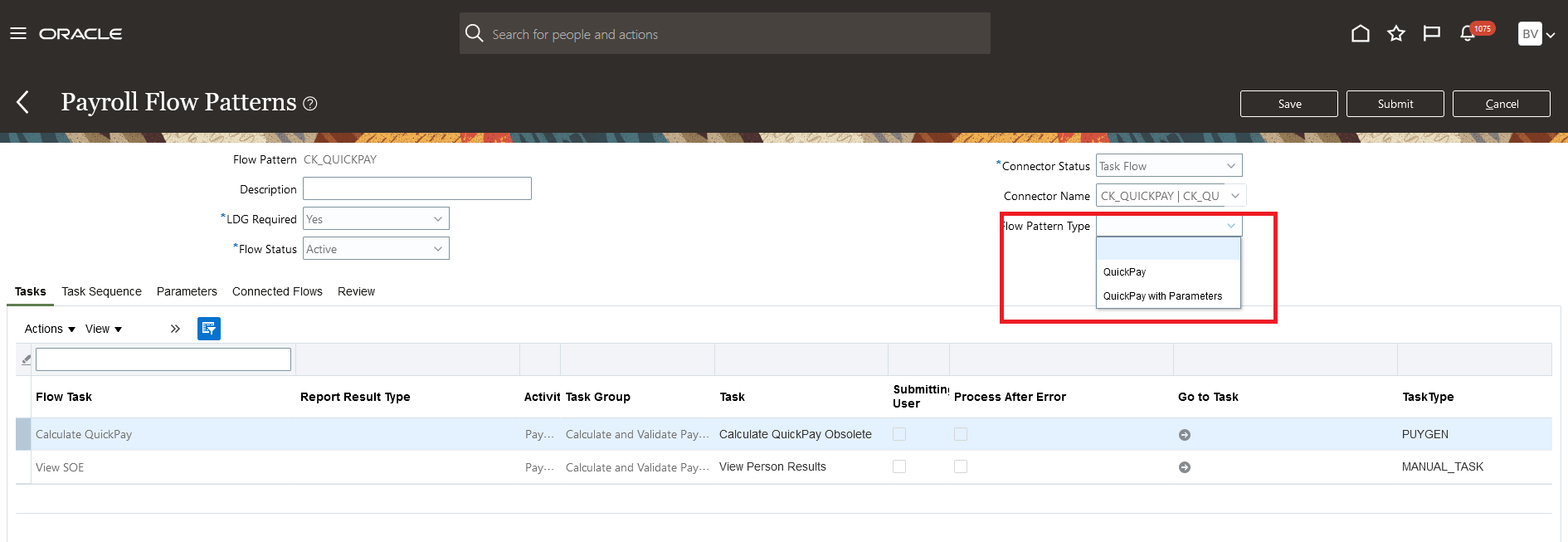

Oracle Fusion Cloud Payroll 22a What S New

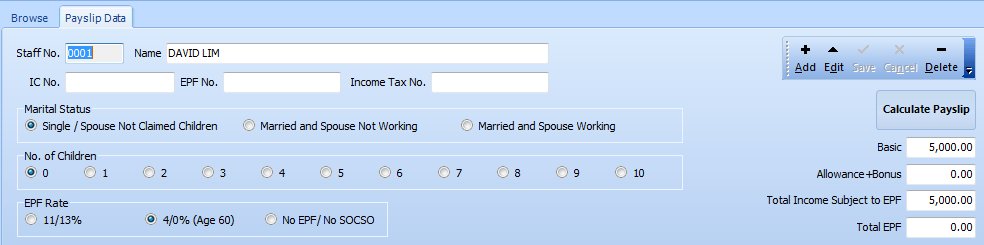

Free Salary Calculator Operating Manual Actpay Payroll Services Malaysia

School Supply Lists For The 2022 2023 School Year

Oracle Fusion Cloud Payroll 22a What S New

How To Set Up Your Client S Payroll

Zljmfwprtihwbm

San Francisco Pay Locality General Schedule Pay Areas

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Payroll Template Excel Get Free Excel Template

2023 Federal Employee Leave Calendar Maximize Your Valuable Time

6sezjlwx My Lm

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Attendance Sheet Template

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Payroll Worksheet Template

Payroll Template Excel Get Free Excel Template

2

Oracle Fusion Cloud Payroll 22a What S New

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms